Retirement Mode

Retirement Model in NPS

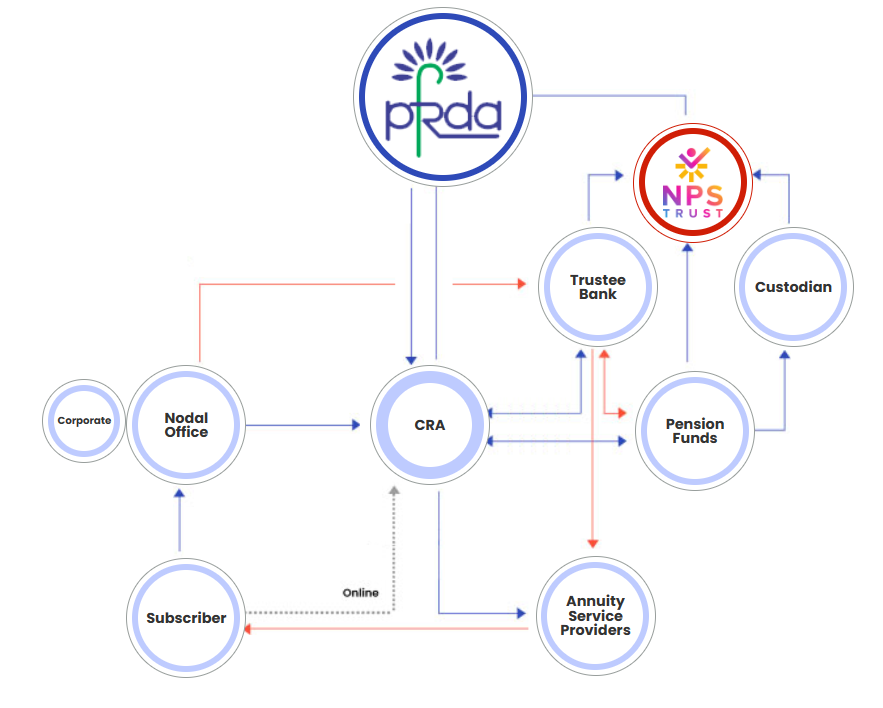

The Retirement Model in the National Pension System (NPS) is designed to provide a structured and sustainable financial plan for individuals during their retirement years. Here’s an overview of the key features:

Contributions:

- Individuals, including employees from the corporate and unorganized sectors, contribute regularly to their NPS accounts.

- Contributions can be made until retirement age, ensuring long-term savings.

Investment Options:

- NPS offers a range of investment choices, including equity, fixed deposits, corporate bonds, liquid funds, and government funds.

- Subscribers can allocate their contributions among these options based on their risk tolerance and financial goals.

More Key Features:

Tier-I and Tier-II Accounts:

- Tier-I is a mandatory pension account with restrictions on withdrawals, ensuring a dedicated retirement corpus.

- Tier-II is a voluntary savings account with more flexibility in withdrawals for specific needs.

Life-Cycle Approach:

- NPS adopts a life-cycle investment strategy, adjusting the asset allocation based on the subscriber’s age. It tends to be more equity-oriented for younger investors and gradually shifts towards safer options as retirement approaches.

Retirement Corpus Utilization:

- At retirement, a portion of the accumulated corpus must be used to purchase an annuity, providing a regular pension income.

- Subscribers have the flexibility to withdraw the remaining corpus in a lump sum or in installments, offering financial flexibility.

Partial Withdrawals:

- NPS allows partial withdrawals for specific purposes such as education, marriage, or purchasing a house, subject to certain conditions.

Tax Benefits:

- Contributions to NPS are eligible for tax deductions under Section 80CCD of the Income Tax Act, providing additional incentives for retirement savings.

Financial Literacy:

- NPS emphasizes financial literacy, empowering subscribers to make informed decisions about their retirement planning.

The NPS Retirement Model aims to provide a comprehensive and personalized approach to retirement savings, combining investment flexibility, tax advantages, and a structured payout mechanism to ensure financial security in retirement.

Mission

"Empowering all citizens through NPS: Inclusive, accessible, and secure pension solutions for financial well-being and a dignified retirement."

Vision

"Vision for All Citizens Mode in NPS: Universal access, financial inclusion, and retirement security, fostering a prosperous and sustainable future for every individual."

Values

"Values of All Citizens Mode in NPS: Inclusivity, Transparency, Security - Enabling every citizen's journey towards financial resilience and retirement well-being."